Office Chair Depreciation

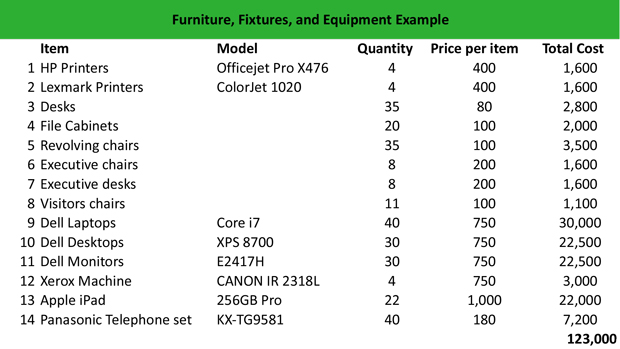

114347 09-27-2018 File Cabinet Contracts. So if the 10000 of furniture was part of capital investments above 500000 there would be an additional 3000 of depreciation allowed for 2019 on that furniture.

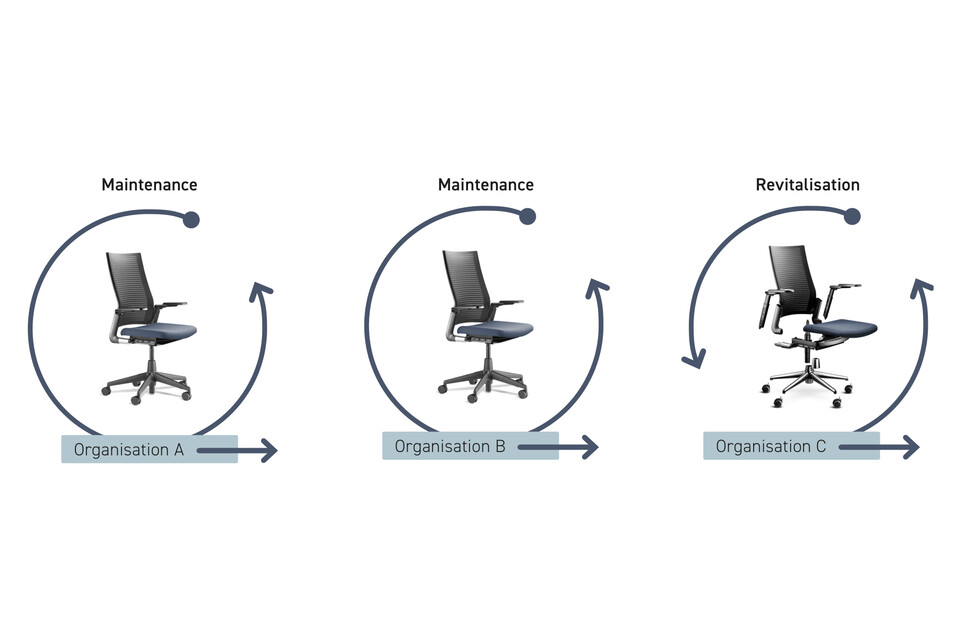

A Practical Guide To Managing Unused Assets October 23 2019 Cscmp S Supply Chain Quarterly

The salvage value of furniture may be zero resulting in the total purchase price being expensed of the useful life of the furniture.

Office chair depreciation. The office furniture and equipment you purchase may be fully deductible in the year purchased if it qualifies for the Section 179 deduction. If youre giving away a chair with a broken leg or something equally worthless forget it. So based on our straight-line depreciation rate you can sell your office chair at around 300 more or less after using it for 3 years.

For further explanation read our blog post. 35 months 69 per month 24150. The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life.

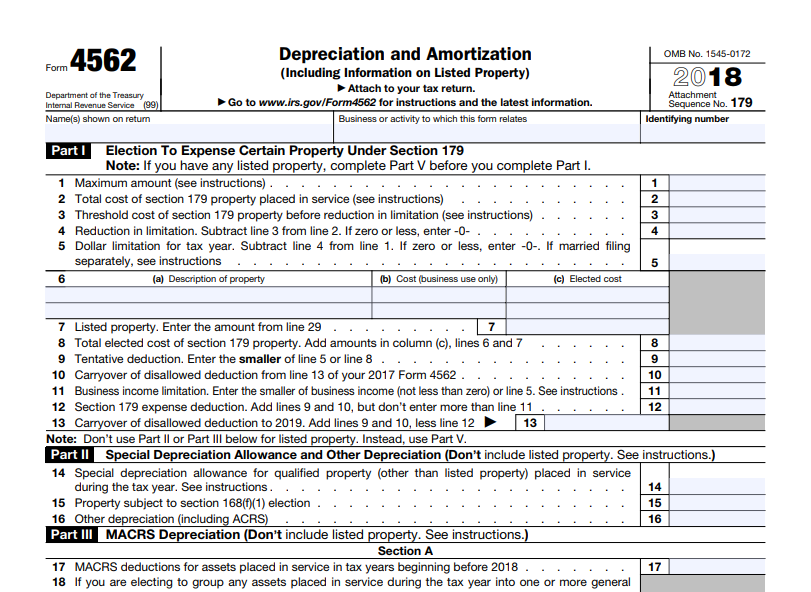

985 365 365 200 4 years 49250. Depreciation for your office furniture and equipment can be calculated on Form 4562. Living with roommates or a significant other.

Depreciation 1000 purchase price 200 salvage value 10 years useful life Depreciation 80010. Base value days held 365 200 effective life in years. The 52 cents per hour rate covers the decline in value of office furniture therefore Linus cannot claim a separate deduction for the decline in value of his chair.

To deduct office supplies on your business tax return you must meet all of these IRS rules. The BPA for file cabinets is available for purchasing to fill ad-hoc or project needs. This number is NOT a professional estimate and is intended primarily for roommates buying and selling shared furniture.

The cost of furniture is the easiest to determine. This represents the annual depreciation a company can expense each year. Use the 1993-2005 rates for.

Buildings acquired as relationship property or under a wholly-owned group company transfer that the previous owner depreciated using the 1993-2005 depreciation rates. The total then is halved to 3000 for the first year deduction. Furniture can be described as any movable asset like a table chair etc.

26Over time chairs computers and other office equipment get stained wear out or break down. If he works from home for one day per week in the 202122 income year and continues to use his computer for work 30 of the time his decline in value deduction will be. 18You bought a cabinet for 1000 and you expect to use it for the next 10 years.

17 March to 30 June 2020. How long an asset is considered to last its useful life determines the rate for deducting part of its cost each year. Thats why the IRS wont allow you to claim purchase price if youve owned the item a while.

29You calculate depreciation using the straight-line method with this formula. This means that office equipment such as computer and security system etc should be depreciated through any accelerated methods of depreciation whereas desks and chairs or staplers should be depreciated on the basis of straight-line method. 9For businesses that exceed 500000 in capital expenditures there is a 30 bonus depreciation rule allowing 30 of the cost of an asset to be depreciated in 2019.

Example of Calculating Straight Line Depreciation. 2일 전Depreciation can be said as the reduction in the value of assets due to continuous wear and tear use of the asset or bypassing of time. In the second year 3000 is subtracted from the purchase price leaving 11000.

50076 5865 7245 63186. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. Buildings that were purchased or to be built and the relevant contract was signed prior to.

Depreciation Cost of Fixed Asset Useful Life of Fixed Asset. This number is not based on market prices but on depreciation which we believe is a better basis for fairness. 17You may deduct 100 of the cost of office supplies and materials you keep on hand and have used during the year.

You have purchased a computer for 1000 and estimate you will keep it for 3 years. Your first year of depreciation is only half of the depreciation of 20 making it 100 divided by 50 50 x. Which are used for making any office or other place suitable for working.

30Depreciation rates are based on the effective life of an asset unless a write-off rate is prescribed for some other purpose such as the small business incentives. What class is office furniture for CCA. 27Specialty type training room chairs.

Splitwise is a free. If it is less than 500 it should not be listed. Your annual depreciation is.

Thus depreciating assets require a useful life estimate. For example the first year deduction for a 14000 purchase of furniture for business use would be 2000 multiplied by 3 for a total of 6000. The instructions for using the Mandatory Chair Contract can be found on the FMSS Project Management SharePoint.

Guest chairs used in private offices. Thats 500 minus 19284. 24150 30 7245.

7Subtract 6428 x 3 years to get the estimated value of your office chair after 3 years. At the end of the 3 years the computer will have no residual value. 5Depreciation limits on business vehicles.

49250 30 work-related use 14775. Its estimated scrap value is 200. You may also deduct the cost of stamps and postage charges and postage used in postage meters during the year.

1Others including bookcases chairs and sofas coatdress-up racks easels room.

Do You Know Your Office Furniture Depreciation Rate

Https Www Hermanmiller Com Content Dam Hermanmiller Documents Investors 10 K Fy19 20 Q4 Pdf

Macrs Depreciation Method Bloomberg Tax Accounting

Can I Claim Office Furniture On My Taxes What You Need To Know

Depreciation Nonprofit Accounting Basics

How Much Is Used Office Furniture Worth Learn To Sell It For More Cash

Furniture Fixtures And Equipment And Depreciation

Herman Miller Questions Answered

What Is Furniture Fixtures And Equipment Ff E Definition Meaning Example

Can I Claim Office Furniture On My Taxes What You Need To Know

Furniture Fixtures And Equipment Business Valuation Induced Info

4 Ways To Depreciate Equipment Wikihow

Reducing Balance Method For Depreciation

Do You Know Your Office Furniture Depreciation Rate

Office Workspace Mid Century Office Design With Black Leather Swivel Chair On Grey Sleek Projeto De Home Office Escritorios De Casa Modernos Mesa Home Office

How To Determine Your Office Furniture Depreciation

Post a Comment for "Office Chair Depreciation"